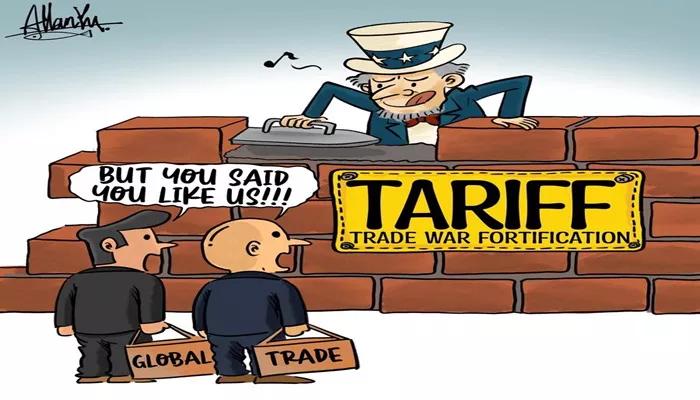

Recently, the United States announced the postponement of imposing high tariffs on the European Union, sending a clear signal of trade tension easing. This move has triggered a positive response in the financial market, with the US stock market surging significantly and investors’ risk appetite rising markedly, reflecting the market’s high sensitivity to improvements in the trade environment.

Haselt, the director of the US National Economic Council, stated that more trade agreements are expected in the future, potentially even within this week. Tariffs on certain countries may be reduced to 10% or lower, and the tariff reduction will apply to countries that offer favorable conditions.

Stock Market Rebound and Asset Price Movements

On Tuesday, the three major US stock indices staged a robust rebound. The Dow Jones Index climbed 1.78%, the S&P 500 Index increased by 2.05%, and the Nasdaq Index soared by 2.47%. Nike announced a price increase for its products sold in the US, and its stock price rose by more than 4%, leading the gains in the Dow Jones Index. NVIDIA’s stock price rose by over 3%. The Invesco US Technology Seven Giants Index jumped 2.9%, Tesla’s share price rose by nearly 7%, and Google’s stock increased by more than 2%. Chinese stocks showed a mixed performance, with Pony.ai surging by over 22% while Pinduoduo dropping by more than 13%.

The US dollar index immediately rose by 0.5% to 99.49, indicating a shift in capital flows towards the US dollar. By the end of trading in New York, the US dollar index had gained 0.64% to reach 99.6147, while most non-US currencies declined. Meanwhile, the safe-haven asset gold fell, with COMEX gold futures dropping 1.27% to $3299.70 per ounce and COMEX silver futures falling 0.77% to $33.39 per ounce.

Positive Economic Data and Trade Prospects

The US consumer confidence index in May recorded better-than-expected results. The data showed that consumers’ expectations for the economy, the job market, and household income have improved, which is closely linked to the market’s confidence in potential progress in trade negotiations. The director of the National Economic Council also told the media in an interview that more trade agreements may be announced in the coming days. Several agreements are on the verge of being reached, pending only final confirmation. He specifically pointed out that India is “one of the countries very close to completing the negotiations” and may become a key trading partner for the US in the future.

Strong Rebound of US Technology Stocks

The technology sector has emerged as the main driving force behind this round of market rebound. Tesla’s stock price rose by nearly 7% after Musk announced that he would refocus on the company’s operations and core technology research and development. Other major technology companies such as NVIDIA, AMD, Apple, and Microsoft also performed strongly, propelling the overall recovery of the Nasdaq index.

Currently in the peak earnings report season, the market is closely watching the fundamental performance of enterprises. Data shows that more than 95% of the companies included in the S&P 500 index have released their earnings reports, and nearly 78% of these enterprises exceeded market expectations, indicating stable overall corporate profitability. This week, major companies including Okta, Macy’s, Costco, and NVIDIA will release their quarterly earnings reports, from which the market will seek more clues about the future business development of these companies and economic cycle trends.

Market Caution Amidst Rebound

Despite the strong short-term market rebound, some analysts have warned that investors should remain vigilant. The Vital Knowledge institution analyzed that currently, the market may be “overconfident” in its response to macro risks such as tariffs, fiscal policies, inflation, and bond market fluctuations. Against the backdrop of high stock market valuations, policy changes or economic data missing expectations could lead to market re-pricing pressure.

Looking back over the past four months, the US government has adjusted import tariffs multiple times. Although the high tariffs on the EU have been postponed this time, some additional measures have already been implemented. If subsequent trade negotiations stall or fail to make substantial progress within the set time frame, market fluctuations triggered by policy uncertainties cannot be ruled out.

Federal Reserve’s Policy Outlook in the Spotlight

At the policy level, one of the key focuses for the market this week is the upcoming release of the latest Federal Reserve policy meeting minutes, as well as the April data of its preferred inflation indicator – the core personal consumption expenditure (PCE) price index. The market hopes to gain insights from these data into the Fed’s policy stance under the current dual pressures of high inflation and economic slowdown, especially whether it will adjust its previous “higher-for-longer” interest rate policy.

Minnesota Fed President Kazakari said at an event in Japan on Tuesday that, given the uncertain global trade situation, he supports keeping the current policy interest rate unchanged, believing that “more clear signals are needed.” He pointed out that tariffs are a supply-side shock, which both pushes up inflation and suppresses economic activities, posing a challenge to monetary policy. “We must choose between fighting inflation and supporting growth.” The market generally interprets that if subsequent inflation data remains stable, the Federal Reserve may choose to hold off on further action when the economic situation is uncertain.

Related topics: