The bill encompasses the following key components: extending the personal and corporate tax cuts introduced during Trump’s 2017 term, reducing social welfare expenditures in areas like healthcare and education, increasing military spending and border security budgets, and raising the federal debt ceiling by $4 trillion.

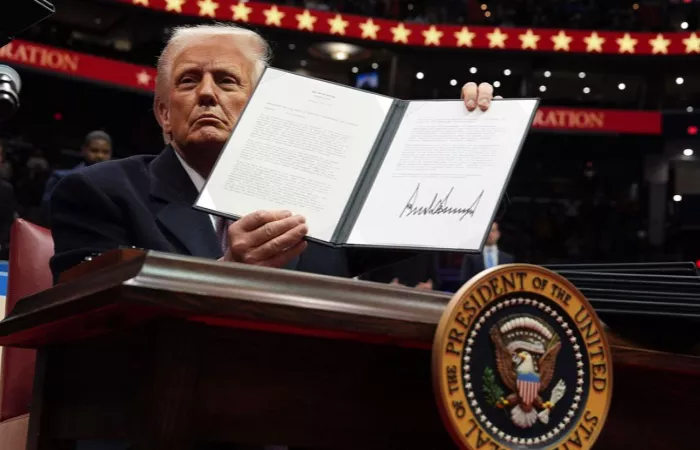

Adoption process:

On May 22, the U.S. House of Representatives passed the bill by a narrow margin of 215 votes in favor and 214 votes against, and will then be submitted to the Senate for consideration.

Differences caused:

Paul and other legislators objected: Rand Paul and other fiscal conservative legislators opposed the bill because it would lead to an increase in the statutory debt ceiling and an increase in national debt, which is not in line with conservative ideas. Paul said he supported the tax cut, but wanted to remove the new $5 trillion in debt, and said at least three Republican senators had the same views as him.

Trump criticized opponents:

Trump fiercely criticized Paul, calling him “crazy” and “there has never been any practical or constructive ideas”.Other legislators have a syinging attitude: Senate Republican leader John Tun believes that raising the debt ceiling is imperative. Florida Senate Rick Scott wants to balance the budget to avoid raising the debt ceiling again in the future, but has previously voted in favor of a budget framework that allows a debt ceiling to be raised. Wisconsin Senator Ron Johnson said that if spending can be drastically cut, a one-year plan to raise the debt ceiling could be supported.

Potential impact:

Economic aspects: According to the Congressional Budget Office (CBO), the bill will cause the U.S. Treasury debt to soar by $3.3 trillion in the next decade, and the ratio of federal debt to GDP will soar from the current 98% to 125%, far exceeding the historical peak after World War II in 1946 ( 118.5%). Rating agencies such as Moody’s have therefore downgraded the U.S. sovereign credit rating from Aaa to Aa1. While tax cuts stimulate consumption and investment, they also push up the core PCE inflation in the United States to 2.7%.

Social aspects:

The bill was criticized by the Democratic Party as “robbing the poor and helping the rich”. The income of the bottom 10% will decrease by 2%, while the top 10% will increase by 4%. Medical subsidy restrictions are expected to cause 7 million people to lose health insurance, and raising the threshold for food coupons will affect tens of millions of families.

Related topic: