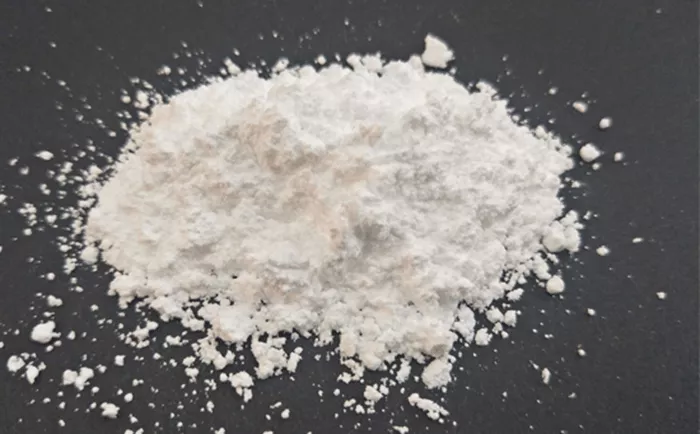

The Shanghai Securities News – China Securities Network (Reporter Li Shaopeng) Lithium carbonate, which has already broken through the “profit and loss line”, has not yet stopped its downward trend. On May 29th, the main contract of lithium carbonate futures dropped by 2.23%, closing at 58,860 yuan per ton, hitting a new low for the year. Looking back at the market situation this year, the lithium carbonate futures contract has continued to decline. Compared with the highest point of 80,000 yuan per ton at the beginning of the year, the cumulative decline has reached 23.66%.

The spot market is also not optimistic. Data from Shanghai Steel United on May 29th showed that the price of battery-grade lithium carbonate (evening session) dropped by 1,000 yuan per ton compared with the previous day, with an average price of 61,000 yuan per ton, also setting a new low for the year.

Insufficient downstream demand is regarded as the main reason for the continuous decline in lithium prices. Market insiders analyze that currently, the global lithium resources and lithium salt production capacity are constantly expanding, with supply growing rapidly. However, the growth rate of the demand side is gradually slowing down, and the inventory pressure on enterprises is increasing day by day. This directly leads to the continuous decline in prices.

The continuous decline in lithium prices has dealt a huge blow to lithium carbonate producers. A senior executive of a lithium mining company in Sichuan Province disclosed that after the price dropped below 70,000 yuan, the company can only reduce production by halting production for maintenance to cut costs, while closely monitoring market dynamics. In fact, most lithium carbonate producers have adopted similar production suspension and maintenance measures at present, attempting to reduce market supply and control cost expenditures.

The industry generally holds a pessimistic attitude towards the subsequent trend of lithium prices. It is extremely difficult for lithium prices to rebound, mainly due to three reasons: First, the trend of increasing supply of lithium carbonate is very obvious; Secondly, downstream demand tends to stabilize and is unlikely to see a significant increase. Thirdly, it will still take some time to clear out high-cost production capacity.

In the face of the current situation where the price of lithium carbonate is unlikely to rebound significantly, industrial companies have been adjusting their future plans one after another. A person from a lithium mining enterprise in the A-share market said that the price decline helps to eliminate enterprises with high costs and low efficiency, promote the survival of the fittest in the industry, and facilitate the concentration of resources on more competitive enterprises. The person also believes that the continuous weakness in prices may lead to an increase in merger and acquisition activities within the lithium industry, and the industry concentration is expected to rise. The competitive advantages of integrated enterprises from upstream resource development to lithium salt production will become increasingly prominent.

It is worth noting that although some processing enterprises in the smelting end have successively suspended production, it will still take some time for the high-cost lithium carbonate production capacity to be cleared. Some insiders from lithium mining enterprises analyzed that there are mainly two reasons why the lithium salt production capacity has not been cleared on a large scale: First, some processing enterprises still hold expectations for the price recovery; Second, the dividends brought by the previous sharp increase in lithium prices have enabled some enterprises to maintain their cash flow for operation. Under the influence of multiple factors, the upward momentum of the lithium carbonate market is insufficient in the short term. The future industry pattern and price trend still need to be further observed.

Related topics: