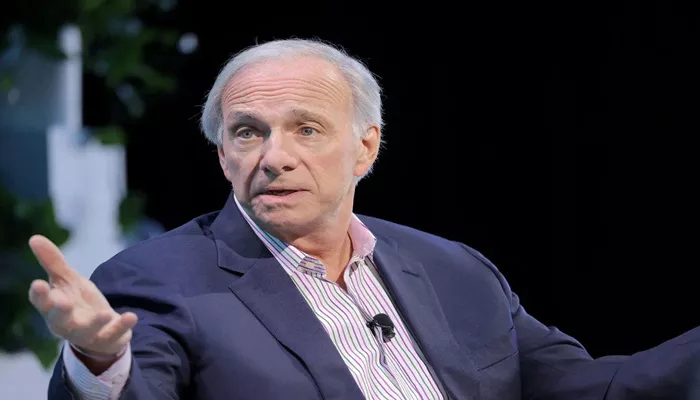

Billionaire investor and Bridgewater Associates founder Ray Dalio has sounded the alarm in his new book, cautioning that the debt situation of the US government is approaching a dead end, with the classic “debt death spiral” on the verge of materializing. While Dalio acknowledges that the risk of a near – term debt crisis in the United States is relatively low, he emphasizes that the long – term risk is extremely high.

In his newly published book “How Countries Go Broke: The Big Cycle” on Tuesday, Dalio wrote that the US government’s debt situation is “heading towards a dead end” and is getting perilously close to a “death spiral” that could threaten the stability of the world’s largest economy.

Growing Concerns in the Financial Community

For years, some economists and investors have been warning about the US deficits. However, this year, as President Trump’s tariff and tax bill agenda has disrupted the bond market, which typically serves as the stable foundation for both the US and global economies, Wall Street has started to take notice.

Investors are becoming increasingly worried that, amidst uncertainties regarding the economic outlook and the attractiveness of US assets, Trump’s “Great Deal” tax bill could put additional pressure on the federal debt burden. In May of this year, the interest rate the US government paid to investors for a 30 – year loan (the 30 – year US bond yield) soared to its highest level since 2023. This was due to investors either selling off the bonds or being reluctant to purchase them, and instead demanding higher compensation for lending to a US government that seemed riskier.

Dalio’s Persistent Warnings

Dalio is among the billionaires who have been consistently warning about the US debt and deficits. He is concerned that the massive government debt will crowd out spending on essential services, leaving the economy hollowed – out, unable to serve its citizens properly, and scaring away global investors.

In his book, Dalio wrote that “the imminent risk of a US government debt crisis is very low”, but “the long – term risk is very high”. He also noted, “Although such an evolution has occurred many times in history, most policymakers and investors believed that their current situation and the monetary system would not change. Such a change was unimaginable – and then it suddenly happened.”

Understanding the “Debt Death Spiral”

A higher deficit implies that the US Treasury may need to sell more bonds to finance its expenditures and interest payments. The “debt death spiral” refers to a situation where the government has to issue more bonds to raise funds to repay existing debts, but faces dwindling demand and has to offer increasingly higher interest rates to entice investors to buy them.

Dalio explained, “When interest rates rise, it leads to an escalation in credit risk, which in turn results in a decrease in debt demand, ultimately leading to a spiral of further rising interest rates. This is the classic ‘death spiral’ of debt.” The higher return demands from investors for government loans will lead to a reduction in the country’s operating funds, drive up interest rates for consumers and businesses, and generally limit a country’s options for raising cash.

Dalio suggested, “For me, this means that US policymakers should be more conservative in handling the government’s finances, rather than less conservative, because the worst – case scenario is poor financial conditions during difficult times.”

Bond Market Turmoil

Moreover, Trump’s tax bill is expected to increase the deficit as it significantly cuts taxes without making sufficient spending cuts to balance the budget. At a Perry Media Council event in New York on May 22, Dalio stated that the current US deficit is on an unsustainable path and “exceeds the market’s tolerance”. He predicted that the United States will be in a “critical situation” in about three years, adding, “I think we should be afraid of the bond market. I can tell you, it’s extremely serious.”

Tax cuts may have been a boon for Wall Street in the past, with the stock market cheering Trump’s tax reduction policies during his first term. But this time, the situation is different. With the federal debt burden already ballooning, tax cuts have further widened the deficit. According to Treasury Department data, the ratio of federal debt to the gross domestic product (GDP) has soared from 104% in 2017 to 123% in 2024.

Just days before Dalio’s book release, Jamie Dimon, CEO of JPMorgan Chase, said at the Reagan National Economic Forum last Friday that the bond market “is about to crack”. Barclays analyst Ajay Rajadhyaksha stated in a recent report, “The yield on long – term US bonds has approached the highest level since the 2008 financial crisis. As the market digests the details of the new tax bill and realizes that the deficit is likely to continue to rise in the foreseeable future, the risk is that the long – term yield may also continue to rise.”

Lack of Bipartisan Cooperation

At the May 22 event, Dalio pointed out that neither the Democratic Party nor the Republican Party has shown the ability to cooperate on this issue. He said, “It’s like a ship that is heading towards a rock. They all agree that it should turn, but they cannot reach an agreement on how to do so.”

Related topics:

- Broker Top Picks for June 3: 4 Reports Recommend This Stock Industrial Valve Leader Neway Leads Analyst Recommendations

- Us Media: White House Chief of Staff’s Mobile Phone Suspected to Have Been “Hacked” – Fbi Initiates Investigation

- People’s Daily Comment: For New Energy Vehicles, The Stimulant of “Price War” Must Not Be Administered