Dollar Index Holds Support Amid Technical Rebound Potential

The US dollar shows signs of stabilization after Wednesday’s pullback, with technical indicators suggesting potential upside across major currency pairs while gold faces resistance near recent highs.

Technical Outlook

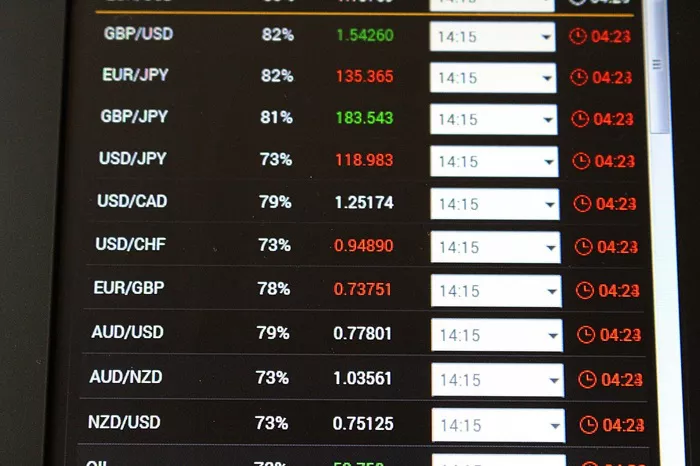

| Instrument | Key Levels | Trading Bias |

|---|---|---|

| DXY (Dollar Index) | Support: 98.50-55 / 98.20-25 Resistance: 98.95-99.00 / 99.20-25 |

Buy dips |

| EUR/USD | Resistance: 1.1450-55 / 1.1480-85 Support: 1.1400-05 / 1.1370-75 |

Sell rallies |

| Gold (XAU/USD) | Resistance: 3392-93 / 3409-10 Support: 3351-52 / 3327-28 |

Sell into strength |

Trading Strategy Recommendations

USD Index

Range: 99.25 – 98.50

Action: Buy at lower bound

Stop: 30 pips below 98.50

Target: Upper bound

EUR/USD

Range: 1.1455 – 1.1370

Action: Sell at upper bound

Stop: 40 pips above 1.1455

Target: Lower bound

GBP/USD

Range: 1.3595 – 1.3510

Action: Sell at upper bound

Stop: 40 pips above 1.3595

Target: Lower bound

USD/CHF

Range: 0.8230 – 0.8145

Action: Buy at lower bound

Stop: 40 pips below 0.8145

Target: Upper bound

USD/JPY

Range: 143.30 – 142.15

Action: Buy at lower bound

Stop: 40 pips below 142.15

Target: Upper bound

AUD/USD

Range: 0.6520 – 0.6465

Action: Sell at upper bound

Stop: 30 pips above 0.6520

Target: Lower bound

USD/CAD

Range: 1.3715 – 1.3630

Action: Buy at lower bound

Stop: 30 pips below 1.3630

Target: Upper bound

Gold (XAU/USD)

Range: 3393 – 3351

Action: Sell at upper bound

Stop: $20 above 3393

Target: Lower bound

Execution Notes

- All positions should implement stop-loss orders as specified

- Take-profit at 30+ pips for favorable moves

- Cancel pending orders before US market open if not filled

- Margin traders may adjust position sizes accordingly

- Cash account traders should consider wider stops

Related topics: